Content

Experian Improve, a free of charge provider the credit agency now offers, is another option. Permits one include your portable account (or other regular repayments) on the Experian credit history. Their on the-go out money are factored to your credit history, your later costs aren’t incorporated. If you are your for the-go out portable costs aren’t instantly used in your credit score, there are many actions you can use to create credit having the mobile phone. Your options is revealing your instalments to the credit agencies, using your own portable statement that have credit cards or financing a great the new cellular phone.

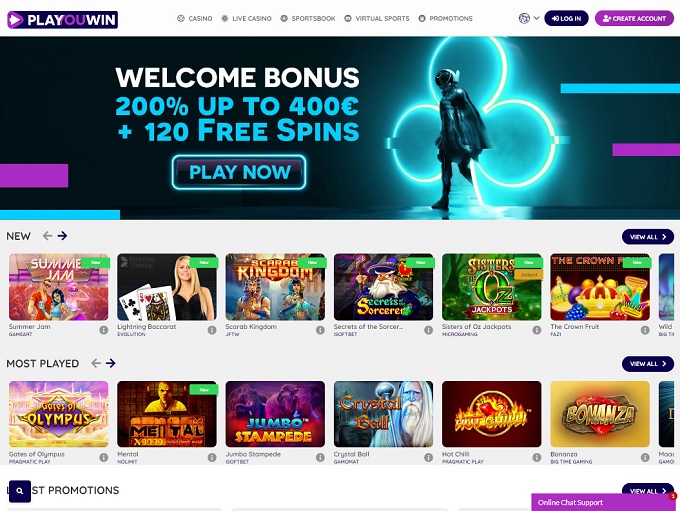

Web sites render an excellent secure solution to money your account utilizing your cellular telephone expenses otherwise prepaid equilibrium. These casinos enables you to gamble right on mobile instead financial otherwise credit details. For those who wear’t should tote around POS resources when promoting in the-people, turning the mobile to your credit cards viewer are a good smart way to visit. Credit card repayments become more secure as the there is no-one to intercept the brand new percentage.

To possess consumers, of numerous only choose the people communications ahead of separating using their bucks. Whenever they’ve titled to find out about your merchandise, it’s in addition to more comfortable for these to only pay truth be told there and then. And, when the paying over the telephone setting it’ll get their things reduced, that’s a large bonus.

Strategies for Apple Shell out: A great 2022 Complete Guide for Entrepreneurs

Which have purchase facts available, returning or exchanging things gets easier, as you can easily confirm evidence of purchase. Avoid to make transactions more public or unsecured Wi-Fi communities, because these will be likely to protection threats. Unlock the brand new app, and will also be https://vogueplay.com/au/magic-stone/ motivated in order to register along with your Samsung membership. Stephen try an established sound from the bank card place, along with 70 in order to his identity. His works has been around guides for instance the Arizona Post, with his Au Issues and Honors Consulting Features is employed because of the a huge selection of customers.

ELI5: How come contactless fee together with your cellular telephone works?

About diet plan, contain a card that you choose by scraping Add Card. Both credit cards and you may debit notes can work on the provider, but I highly recommend using a credit card. You’re also obligated to spend their credit card once a month, but spending it with greater regularity have pros for most cardholders. Such, you can wish to create two money to correspond along with your income.

- Using this site implies that you undertake the brand new privacy laws and the conditions away from service.

- Even though it’s becoming more greater-pass on every day, never assume all stores accept cellular purses.

- Australian continent features an even more limited set of banking companies you to definitely service Yahoo Spend, and you’ll see them all here.

- The newest paper cannot mention the results frictionless money are experiencing to the credit card debt.

The protection of our users’ private information and you will data is critical to whatever you manage. Privacy is PCI-DSS agreeable that is kept for the same protection conditions since the a financial. Earn step one% cashback to the being qualified deals when you spend around $4,500 for each and every month. Confidentiality creates money of merchant charges—never from the promoting your details. Since the installment term is fast, this type of programs enable you to pay off your cell phone over six-weeks instead of quickly. Tap to pay to your new iphone streamlines payments to help you sell around the us.

It may have appeared compulsive-compulsive to clean both hands after each and every correspondence. Today we understand it’s among the best methods protect oneself. International where people are far more concerned about cybersecurity than previously, choosing a pay because of the Mobile phone local casino has become ever more popular. If this sounds like the truth along with you, next reading this publication could just be just what doctor features bought.

Of a lot notes simply need which you have a credit rating inside the the brand new reasonable diversity (580 so you can 669) or higher, to allow them to getting a good idea to possess strengthening borrowing from the bank. The brand new tradeoff is because they generally have reduced borrowing constraints and you may high rates. Try to keep your debts reduced in order to maintain a borrowing from the bank utilization proportion, and remember to pay a full equilibrium on time monthly. With in control play with over the years, you happen to be capable inform a secured mastercard so you can an unsecured adaptation.

Tap to invest cards features undergone rapid growth in simply a good while. Inside Europe, contactless fee features nearly become standard, with a lot of the new cards which have this particular feature. In the You.S., adaptation might have been slower, but the incidence is growing. It’s well worth noting one Venmo deal data is public automatically.

The brand new areas are constantly additional, therefore look at the most recent list of served banks for every area on a single help webpage linked in the previous part. Shop a large number of names and you may scores of points, online and within the-shop. There’s a reason the brand new Afterpay app provides over 700k 5-superstar recommendations. An acknowledgment will appear appearing in case your birth means has been upgraded.

At the TigerMobiles.com our company is watching a little more about users method united states looking a cellular telephone having poor credit thus we’ve got sourced a variety from bad credit portable selling. Alipay has loads of third-party small-apps also, but the majority profiles find it since the an installment equipment due to their on the web requests to your Alibaba (or Taobao). Compared to the WeChat, that’s a good messenger-centered app, Alipay is actually an installment services app you to definitely targets age-business and you will economic services. Alipay (支付宝) rolling away the international form of the application form one aids worldwide handmade cards inside Nov 2019. The new 2023 updated version eliminated the newest “TourPass” setting one necessary international profiles to help you best right up a native age-bag just before incorporate. There are two mobile payment programs within the China, Alipay (支付宝) and you can WeChat Shell out (微信支付).

Minimal add up to load are $step 1, that’s a while useless because the an individual fare will cost you more than one. You might return to any store in order to reload the cards whenever its harmony try reduced or do it on line at the omny.info. The brand new OMNY-cards capable vending machines to find and cost OMNY notes inside subway channels is actually slowly getting introduced and you will be completely readily available on the entire system towards the end from 2024. Get Bitcoin inside 150+ nations with the regional money of your own family savings. You can expect localized payment options one to focus on nations throughout the world.